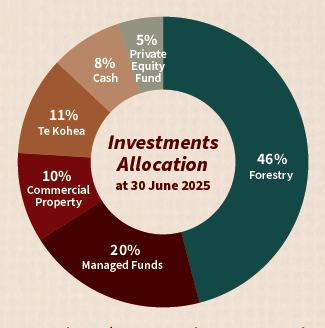

INVESTMENT OVERVIEW

The Trust was established in 2009 to receive the accumulated rentals from the Central North Island Forests Collective Settlement and to take a lead role within Ngāti Whakaue to advance charitable purposes. The Trust has grown its total net asset base from $9.3m to $29.1m.

current Investments Of the trust

Te Huinga Nehenehe | Forestry

Forestry is the Trust’s largest asset, accounting for approximately 46% of total assets. The Trust is invested through Te Kākano Whakatipu - a collective of six Central North Island iwi entities (includes Raukawa, Tuwharetoa, Ngāti Whare, Ngāti Rangitihi, Te Arawa Group Holdings), which owns a 2% shareholding in the Kāingaroa Timberlands forestry estate.

Te Huinga Tūwāhi | Property

In December 2022 the Trust was excited to share news of the joint investment with Pukeroa Oruawhata Trust and Ngāti Whakaue Education Endowment Trust Board, to purchase the Rainbow Springs (Te Kohea) property from Ngai Tahu Holdings. A small team representing the investors are gathering development options for consideration. Like all investments, this will be expected to deliver future returns in line with our Principles, while contributing to our overall Vision. Watch this space!

The Trust has property investments through Hāpai – an iwi owned and managed fund invested in commercial property across the motu. The portfolio currently has commercial investment properties in Auckland, Tauranga, Hawkes Bay, Christchurch, and Dunedin, with high quality tenants and long average lease terms.

Te Huinga Tahua Taurima | Managed Portfolio Funds

The Trust has investment portfolios with Craigs, Harbour Asset Management, Taurus Resources Fund No. 2/Qmetco and Potentum Partners. Our fund with Taurus Resources No. 2/Qmetco is in the winding down process.